8 Best Bitcoin/Crypto IRA Platforms in 2024

Crypto IRA Platforms are the newest trend in retirement planning. Stay tuned to learn about the risks, benefits, and top crypto/Bitcoin IRAs. Individual Retirement Accounts (IRAs) are the most well-known component of this problem. However, as with anything else, crypto has grabbed people’s interest, with its value soaring over the years (or falling to ashes with just a tweet). However, consumers are still drawn to crypto IRAs because their overall view of cryptocurrency is positive. But first, it’s critical to comprehend…

What exactly are Crypto IRAs?

Crypto IRAs are self-directed IRAs (SDIRAs) in which you can buy and sell cryptocurrency through a US-based exchange. SDIRA adheres to the same regulations and taxation rules as any other traditional IRA. Still, it’s worth noting that the IRS considers cryptocurrencies to be property, much like equities and bonds. But whether these techniques achieve the promised exponential increases or suffer unanticipated drawbacks is anyone’s guess.

Benefits and Drawbacks of Crypto IRAs

The main advantage of crypto IRAs is the option to invest in cryptocurrency for retirement, which is not feasible with traditional IRAs. Furthermore, this aids in portfolio diversification. Aside from the volatility, the limited application of cryptocurrencies might be a huge turnoff.

Regardless of price rises (and falls), bitcoin adoption in everyday life remains negligible.

Furthermore, transaction fees can reduce the final investment. Furthermore, crypto IRAs are not yet widely available, establishing a monopoly.

8 Best Bitcoin/Crypto IRA Platforms in 2024

People are interested in crypto IRAs, and we’re sure which is why you’re here in the first place. If you’re dead bent on going the crypto route, check out these crypto IRA platforms.

1. iTrustCapital

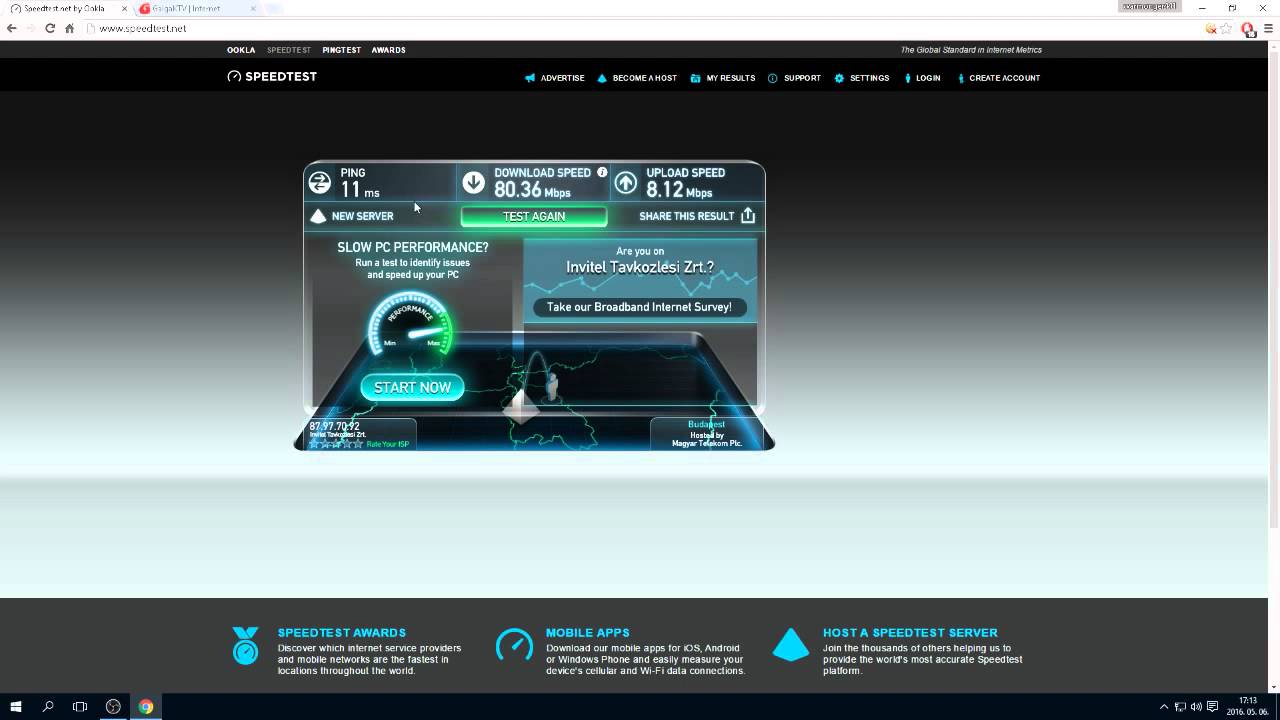

Within its crypto IRA, iTrustCapital gives you the option to invest in gold and silver. However, there is a $1000 account minimum and a selection of over 25 cryptocurrencies. Nonetheless, major crypto coins such as BTC, LTC, ETH, SOL, XLM, BCH, and others are there.

For crypto trading, you’ll simply have to pay a 1% transaction fee. However, there are additional fees for trading in actual gold and silver. Furthermore, converting a regular, Roth, or SEP IRA will cost an additional $75.

Your assets are held in institutional-grade custodians such as Coinbase and Fireblocks by iTrustCapital. You cannot, however, pick between the two. Finally, if you need to invest in precious metals and don’t mind the minimal investment criterion, this could be an excellent option.

2. AltoIRA

Alto’s CryptoIRA offers you to invest in 150+ crypto coins using Coinbase. The nicest part about this crypto IRA is the straightforward pricing structure, which contains only one thing to remember—a 1% transaction charge.

Surprisingly, this also includes Coinbase transaction costs. Except for the account closure ($50) and wire transfer ($25), there are no account setup or annual fees. Furthermore, there are virtually no investment minimums ($10). Non-crypto assets, on the other hand, require a separate IRA.

Alto also allows you to transfer or rollover existing traditional Roth, SEP, SIMPLE IRA, 401(k), and 403(b) plans into your crypto IRA. Finally, Alto offers a free service to assist you in setting up or funding your Crypto IRA.

3. BitcoinIRA

BitcoinIRA offers 60+ crypto assets, but what distinguishes it is its 100% offline, cold storage. It differs slightly from the platforms covered thus far. First, there is no transaction cost; nevertheless, there is a custodian, security, and one-time service fee that is determined by the investment amount and must be enquired about individually from the support executives. BitcoinIRA, like others, allows for the transfer of existing IRAs or other retirement plans.

4. Choice

Choice, as the name suggests, is one of the most versatile CryptoIRA platforms you’ll ever need. They provide three types of accounts based on individual needs:

Account Cold Storage No Annual Charge (1% yearly fee)

Self-Custodial ($500 initial setup, $10/month)

Notably, there is an additional 1% trading fee that applies to all transactions. Furthermore, there are no minimums, and you can swap between options at any time.

Similarly, you can combine all of your retirement accounts into one using Choice. The best feature, though, is the ability to invest in cryptocurrency, gold, ETFs, equities, and other assets through a single retirement account.

5. Broad Financial

Broad Financial crypto IRA is the most self-sufficient alternative, allowing you to invest in the cryptocurrency exchange of your choosing. This is a wonderful situation in which you control the private keys and are not bound by a minimum investment.

You can also invest in a wide range of asset classes. Finally, this allows you complete checkbook control and is based on a set cost that you must inquire about with customer support.

6. BlockMint

BlockMint, a Lear Capital product, offers a premium cryptoIRA with a $10,000 minimum commitment. Transfers and rollovers from existing IRAs and 401k-like retirement plans are supported by BlockMint.

They charge a hefty 15% transaction fee yet provide volume discounts. Furthermore, the custodian (Equity Trust) charges a 2.5% fee on purchases and a 1.0% fee on sales.

In addition to the yearly $195 account maintenance fee, there is a 0.05% storage charge on the crypto IRA assets. Finally, this appears to be the most expensive of the lot that you may save until last.

7. TradeStation

TradeStation is a one-stop IRA for investing in alternative assets such as cryptocurrency, stocks, and so on, with no crypto custody charge. Furthermore, there is no minimum holding. TradeStation, on the other hand, levies service fees and account termination fees based on the amount invested.

8. BitTrustIRA

BitTrustIRA’s 100% cold crypto storage in disused nuclear bunkers makes it an ideal platform for anyone looking for more than the usual military-grade protection. This cryptoIRA has no fixed investment limits. However, there is a one-time setup fee of $50 in addition to the buying (5%) and selling (1%). Furthermore, supplementary services such as wire transfers, account termination, and so on must be paid for.

Conclusion

When it comes to risky investments, cryptocurrency is at the top of the list. So, before choosing a crypto IRA site, do your homework. Even platforms that advertise no hidden fees may deceive their clients. So, for the best experience, read the terms, customer reviews, and real-life comments from your peers.